Michigan Real Estate Transfer Tax Exemptions . notice regarding document required for srett refunds under exemption u. michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of. real estate transfer tax (excerpt) act 134 of 1966. the following written instruments and transfers of property are exempt from the tax imposed by this act: the following written instruments and transfers of property are exempt from the tax imposed by this act: Property from the estate of a decedent is willed to. Michigan state real estate transfer tax. The transfer is exempt under mcl 207.526(a) of the srett act.

from www.pdffiller.com

notice regarding document required for srett refunds under exemption u. in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of. real estate transfer tax (excerpt) act 134 of 1966. Michigan state real estate transfer tax. the following written instruments and transfers of property are exempt from the tax imposed by this act: the following written instruments and transfers of property are exempt from the tax imposed by this act: The transfer is exempt under mcl 207.526(a) of the srett act. Property from the estate of a decedent is willed to. michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,.

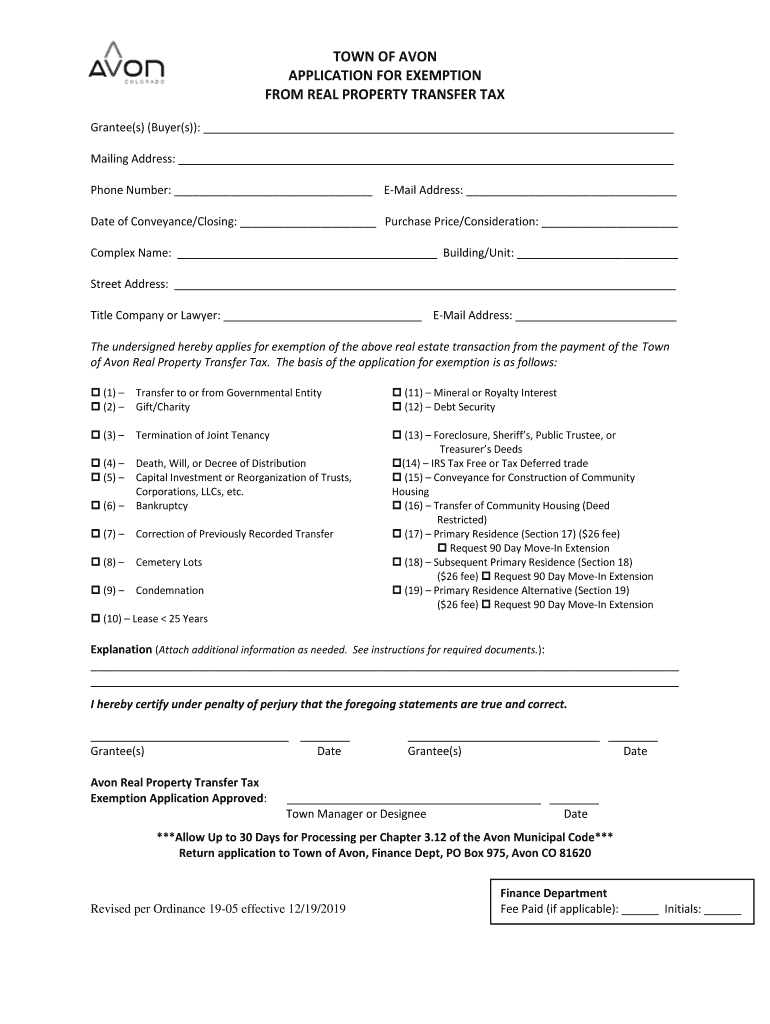

Fillable Online Avon council questions real estate transfer tax

Michigan Real Estate Transfer Tax Exemptions the following written instruments and transfers of property are exempt from the tax imposed by this act: in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of. the following written instruments and transfers of property are exempt from the tax imposed by this act: Michigan state real estate transfer tax. michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. the following written instruments and transfers of property are exempt from the tax imposed by this act: notice regarding document required for srett refunds under exemption u. The transfer is exempt under mcl 207.526(a) of the srett act. real estate transfer tax (excerpt) act 134 of 1966. Property from the estate of a decedent is willed to.

From listwithclever.com

What Are Transfer Taxes? Michigan Real Estate Transfer Tax Exemptions real estate transfer tax (excerpt) act 134 of 1966. Property from the estate of a decedent is willed to. notice regarding document required for srett refunds under exemption u. the following written instruments and transfers of property are exempt from the tax imposed by this act: the following written instruments and transfers of property are exempt. Michigan Real Estate Transfer Tax Exemptions.

From cemxirmg.blob.core.windows.net

Virginia Real Estate Transfer Tax at Eric Lyons blog Michigan Real Estate Transfer Tax Exemptions real estate transfer tax (excerpt) act 134 of 1966. The transfer is exempt under mcl 207.526(a) of the srett act. Property from the estate of a decedent is willed to. in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of. the following written instruments and transfers of. Michigan Real Estate Transfer Tax Exemptions.

From alfanolawoffice.com

Have a Revocable Trust? Real Estate is Exempt from the Real Estate Michigan Real Estate Transfer Tax Exemptions real estate transfer tax (excerpt) act 134 of 1966. the following written instruments and transfers of property are exempt from the tax imposed by this act: The transfer is exempt under mcl 207.526(a) of the srett act. Michigan state real estate transfer tax. Property from the estate of a decedent is willed to. in accordance with the. Michigan Real Estate Transfer Tax Exemptions.

From ryanwilliams.ca

BC Government Announces Property Transfer Tax Exemptions Ryan Michigan Real Estate Transfer Tax Exemptions real estate transfer tax (excerpt) act 134 of 1966. in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of. Michigan state real estate transfer tax. notice regarding document required for srett refunds under exemption u. The transfer is exempt under mcl 207.526(a) of the srett act. . Michigan Real Estate Transfer Tax Exemptions.

From cemuhbit.blob.core.windows.net

Who Pays Real Estate Transfer Tax In Ohio at Kareem Russell blog Michigan Real Estate Transfer Tax Exemptions Property from the estate of a decedent is willed to. the following written instruments and transfers of property are exempt from the tax imposed by this act: notice regarding document required for srett refunds under exemption u. the following written instruments and transfers of property are exempt from the tax imposed by this act: real estate. Michigan Real Estate Transfer Tax Exemptions.

From www.slideshare.net

Real Estate Transfer Tax Declaration of Consideration Michigan Real Estate Transfer Tax Exemptions The transfer is exempt under mcl 207.526(a) of the srett act. in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of. real estate transfer tax (excerpt) act 134 of 1966. the following written instruments and transfers of property are exempt from the tax imposed by this act:. Michigan Real Estate Transfer Tax Exemptions.

From www.pdffiller.com

Fillable Online Avon council questions real estate transfer tax Michigan Real Estate Transfer Tax Exemptions michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. real estate transfer tax (excerpt) act 134 of 1966. the following written instruments and transfers of property are exempt from the tax imposed by this act: the following written instruments and transfers of property are exempt from. Michigan Real Estate Transfer Tax Exemptions.

From www.formsbank.com

Oak Lawn Real Estate Transfer Tax Form printable pdf download Michigan Real Estate Transfer Tax Exemptions michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of. real estate transfer tax (excerpt) act 134 of 1966. Property from the estate of a decedent is willed. Michigan Real Estate Transfer Tax Exemptions.

From www.printableaffidavitform.com

Michigan Real Estate Transfer Tax Valuation Affidavit Form 2024 Michigan Real Estate Transfer Tax Exemptions Property from the estate of a decedent is willed to. in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of. michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. the following written instruments and transfers of property. Michigan Real Estate Transfer Tax Exemptions.

From www.scribd.com

Generally, Any RealEstate Transfer Exceeding 100 in Value Within Michigan Real Estate Transfer Tax Exemptions the following written instruments and transfers of property are exempt from the tax imposed by this act: in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of. michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. . Michigan Real Estate Transfer Tax Exemptions.

From silverlaw.ca

What do I need to know about Property Transfer Tax? Silver Law Michigan Real Estate Transfer Tax Exemptions the following written instruments and transfers of property are exempt from the tax imposed by this act: real estate transfer tax (excerpt) act 134 of 1966. notice regarding document required for srett refunds under exemption u. michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. Michigan. Michigan Real Estate Transfer Tax Exemptions.

From www.scribd.com

Estate Tax and Some Exempt Transfers PDF Estate Tax In The United Michigan Real Estate Transfer Tax Exemptions michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. notice regarding document required for srett refunds under exemption u. the following written instruments and transfers of property are exempt from the tax imposed by this act: real estate transfer tax (excerpt) act 134 of 1966. Property. Michigan Real Estate Transfer Tax Exemptions.

From moneyquince.com

Real Estate Transfer Taxes by State Michigan Real Estate Transfer Tax Exemptions Property from the estate of a decedent is willed to. michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. The transfer is exempt under mcl 207.526(a) of the srett act. Michigan state real estate transfer tax. notice regarding document required for srett refunds under exemption u. in. Michigan Real Estate Transfer Tax Exemptions.

From medium.com

Navigating the New Era of Home Buying in BC A Guide to Updated Michigan Real Estate Transfer Tax Exemptions real estate transfer tax (excerpt) act 134 of 1966. the following written instruments and transfers of property are exempt from the tax imposed by this act: the following written instruments and transfers of property are exempt from the tax imposed by this act: Michigan state real estate transfer tax. Property from the estate of a decedent is. Michigan Real Estate Transfer Tax Exemptions.

From yamichigan.com

Real estate transfer tax relief Arab American Business News Michigan Real Estate Transfer Tax Exemptions michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. Michigan state real estate transfer tax. Property from the estate of a decedent is willed to. the following written instruments and transfers of property are exempt from the tax imposed by this act: The transfer is exempt under mcl. Michigan Real Estate Transfer Tax Exemptions.

From www.theoldfathergroup.com

Real Estate Transfer Tax What Are They & Where Does The Money Go Michigan Real Estate Transfer Tax Exemptions real estate transfer tax (excerpt) act 134 of 1966. The transfer is exempt under mcl 207.526(a) of the srett act. the following written instruments and transfers of property are exempt from the tax imposed by this act: notice regarding document required for srett refunds under exemption u. michigan statute defines “transfer of ownership” generally as the. Michigan Real Estate Transfer Tax Exemptions.

From www.exemptform.com

How To Fill Out A Michigan Sales Tax Exemption Form Michigan Real Estate Transfer Tax Exemptions real estate transfer tax (excerpt) act 134 of 1966. michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property,. notice regarding document required for srett refunds under exemption u. Michigan state real estate transfer tax. in accordance with the michigan constitution as amended by michigan statutes, a. Michigan Real Estate Transfer Tax Exemptions.

From www.formsbirds.com

TP584 Combined Real Estate Transfer Tax Return, Credit Line Mortgage Michigan Real Estate Transfer Tax Exemptions the following written instruments and transfers of property are exempt from the tax imposed by this act: in accordance with the michigan constitution as amended by michigan statutes, a transfer of ownership causes the taxable value of. Michigan state real estate transfer tax. the following written instruments and transfers of property are exempt from the tax imposed. Michigan Real Estate Transfer Tax Exemptions.